Achieve Financial Success with Our Professional Counselling-- Contact Us Now

Why Prioritizing Your Financial Wellness Consists Of Looking For Specialist Credit Scores Therapy Solutions for Lasting Financial Obligation Alleviation

In a world where monetary choices can dramatically influence our existing and future wellness, the significance of looking for specialist credit report therapy services can not be overemphasized. Achieving lasting debt relief includes greater than just making repayments; it requires a calculated technique that resolves the origin causes of economic distress. By employing the guidance of specialists in credit report therapy, individuals can get beneficial insights, resources, and support to navigate their means in the direction of monetary stability. This opportunity supplies an alternative point of view on taking care of debt and producing a path towards a secure economic future.

Advantages of Expert Credit Scores Coaching

Involving in professional credit score therapy can offer individuals with tailored monetary techniques to successfully take care of and minimize their financial obligation worry. By evaluating a customer's monetary scenario comprehensively, credit score therapists can develop personalized debt management plans that suit the individual's details needs and objectives.

Additionally, professional credit report therapy solutions frequently give useful education and learning on financial proficiency and money administration. In general, the benefits of experienced credit therapy prolong past financial debt relief, helping individuals develop a solid foundation for lasting financial well-being.

Comprehending Financial Debt Relief Options

When dealing with overwhelming debt, people have to thoroughly evaluate and recognize the numerous available options for financial debt relief. One typical financial obligation relief option is financial debt loan consolidation, where numerous financial obligations are integrated right into a solitary financing with a reduced rate of interest price.

Insolvency can have durable effects on credit rating and financial future. Looking for professional credit score therapy solutions can aid individuals analyze their financial scenario and identify the most appropriate financial debt alleviation choice based on their certain scenarios.

Creating a Personalized Financial Strategy

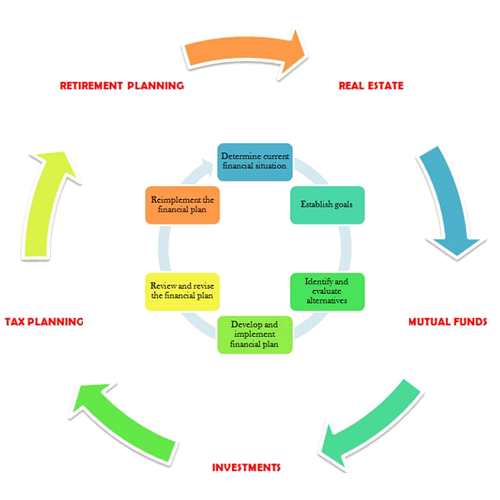

Thinking about the different debt alleviation options readily available, it is essential for individuals to develop a tailored monetary plan customized to their details scenarios. A personalized financial plan works as a roadmap that outlines a clear path in the direction of attaining financial security and freedom from financial obligation. To start establishing this strategy, people should initially evaluate their present financial scenario, consisting of income, costs, possessions, and responsibilities. This evaluation provides a detailed understanding of one's monetary standing and assists recognize locations for renovation.

Next, establishing practical and certain monetary goals is vital. Regularly keeping track of and adjusting this budget plan as needed is important to remain on track towards economic goals.

Moreover, looking for expert credit score counseling services can supply useful advice and assistance in creating an individualized economic plan. Credit report therapists can use skilled advice on budgeting, debt administration techniques, and monetary planning, helping individuals make informed decisions to secure a steady financial future.

Value of Budgeting and Conserving

Effective financial administration through budgeting and conserving is basic to attaining lasting economic stability and success. Budgeting enables people to track their income and expenses, enabling them to focus on spending, determine locations for potential savings, and avoid unneeded financial debt. By developing a spending plan that lines up with their economic objectives, people can effectively intend for the future, whether it be developing a reserve, conserving for retirement, or purchasing assets.

Conserving is just as important as it gives a monetary safety net for unforeseen expenses and helps individuals work in the direction of their financial objectives. In significance, conserving and budgeting are cornerstone methods that empower individuals he has a good point to take control of their funds, minimize financial anxiety, and work towards achieving long-lasting economic safety.

Long-Term Financial Security

Accomplishing long-term financial stability is a calculated quest that requires mindful preparation and disciplined economic management. To secure long lasting economic health, individuals need to concentrate on building a solid monetary foundation that can stand up to unforeseen expenditures and financial fluctuations. This foundation includes establishing an emergency fund, handling financial obligation properly, and investing for the future.

One key aspect of long-term monetary stability is producing a sustainable budget plan that straightens with one's economic objectives and concerns. By tracking earnings and costs, people can guarantee that they are living within their methods and saving for future needs. Additionally, saving for retirement is important in maintaining monetary security over the lengthy term. Planning for retirement early and continually contributing to pension can assist people safeguard their economic future.

Final Thought

Finally, looking for specialist credit scores therapy solutions is crucial for achieving lasting debt alleviation and long-term financial security. By recognizing you could try these out debt alleviation alternatives, developing a customized economic plan, and prioritizing budgeting and conserving, people can effectively handle their finances and work in the great site direction of a secure economic future. With the guidance of debt counsellors, individuals can make educated choices and take positive steps in the direction of boosting their financial wellness.

A tailored monetary strategy serves as a roadmap that describes a clear course in the direction of attaining financial security and freedom from financial obligation. In conserving, essence and budgeting are keystone practices that encourage people to take control of their finances, decrease economic stress, and job towards accomplishing long-lasting monetary safety and security.

To safeguard enduring economic health, people should focus on developing a solid economic foundation that can withstand economic changes and unexpected expenses - contact us now. By leveraging professional advice, individuals can browse economic obstacles a lot more efficiently and function in the direction of a lasting debt relief strategy that supports their long-term monetary well-being